child tax credit portal update dependents

Your advance Child Tax Credit payments were based on the children you claimed for the Child Tax Credit on your 2020 tax return or 2019 tax return if your 2020 tax return had not been processed as of the payment determination date for any of your monthly advance Child Tax Credit payments. These FAQs update PDF the Advance Child Tax Credit.

How Can I Claim My Remaining Child Tax Credit Ctc Or Missing Dependent Stimulus Payment In 2022 Irs Refund Payment Delays

Child Tax Credit Update Portal.

. The child tax credit is a credit that can reduce your federal tax bill by up to 3600 for every qualifying child. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Child Tax Credit update - Direct monthly 300 payments to ordinary Americans to begin this month Biden says. Half of the money will come as six monthly payments and. 29 at the portal IRSgovchildtaxcredit2021.

The full monthly child tax credit benefit is eligible for incomes up to 75000 for individuals 112500 for heads of household and 150000 for married couples. WASHINGTON The Internal Revenue Service today upgraded a key online tool to enable families to quickly and easily update their bank account information so they can receive their monthly Child Tax Credit payment. If something happens that you are unable to get the payments you can still get the full child tax credit for that child when you file in 2021.

IR-2021-143 June 30 2021. You may use the IRS tool to update your dependent information. Normally the maximum child tax credit payment is up to 300 per month for each qualifying child age 5 and younger and up to 250 per month for each child ages 6 to 17.

Updating the portal or any changes next year could also result in an additional payment next year if you were underpaid. Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. A nonfiler portal lets you provide the IRS with basic information about yourself and your dependents if you normally.

The Child Tax Credit Update Portal is no longer available but you can see your advance payments total in your online account. The Child Tax Credit Update Portal can be used by families to update the information the IRS has for them that may make them eligible for the credit. President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022.

The IRS tool is available now for certain functions but the IRS projects late summer to update dependent information. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov. The IRS says it will be available later this year If you dont get all the payments for your new child during the year you will be able to claim the missing amount as a credit on your.

To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child tax credit portal. It also provided monthly payments from July of 2021 to December of 2021. WASHINGTON The Internal Revenue Service today updated frequently-asked-questions FAQs for the 2021 Child Tax Credit and Advance Child Tax Credit Payments to describe how taxpayers can now provide the IRS an estimate of your 2021 income using the Child Tax Credit Update Portal CTC UP.

Visit the IRS website to access the Child Tax Credit Update Portal. Those who care for more than one child or dependent can claim up to 16000. At some point the portal will be updated to allow you to update how many dependants you have.

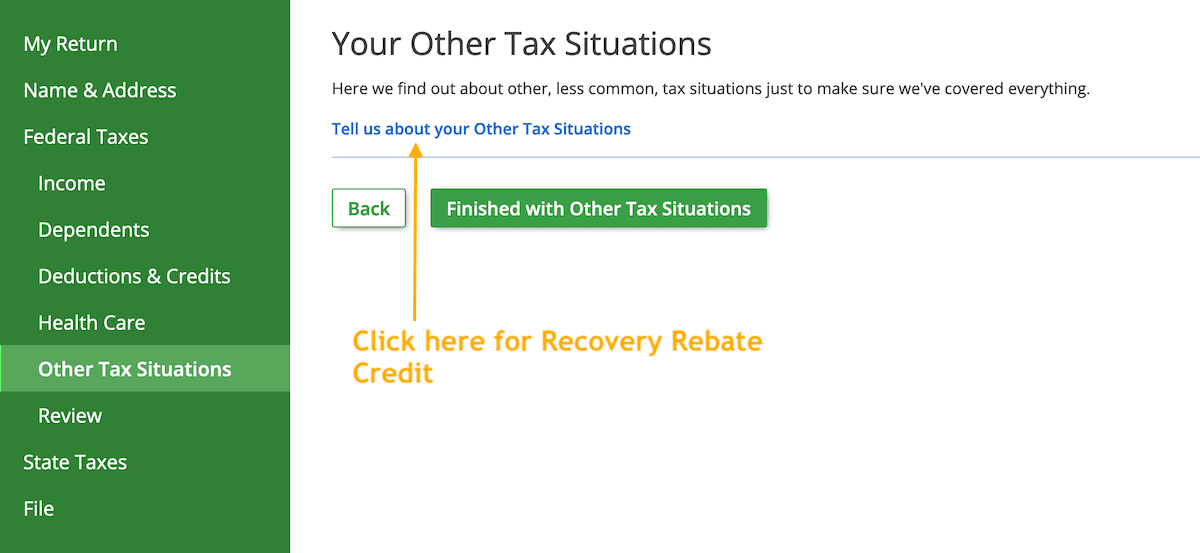

Click the blue Manage Advance Payments button. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account.

The Child Tax Credit Update Portal is no longer available. Changes must be made before 1159 pm ET on Nov. Say Thanks by clicking the thumb icon in a post.

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. The IRS also launched this week a new Spanish-language version of the Child Tax Credit Update Portal. You can no longer view or manage your advance Child Tax Credit.

COVID Tax Tip 2021-167 November 10 2021. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. The IRS will pay 3600 per child to parents of young children up to age five.

If something happens that you are unable to get the payments you can still get the full child tax credit for that child when you file in 2021. Did you see a big pay hike. Heres how they help parents with eligible dependents.

2021 Child Tax Credit and Advance Payments. It begins to phase out after that. To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child tax credit portal.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Schedule 8812 H R Block

Did Your Advance Child Tax Credit Payment End Or Change Tas

Check Advance Child Tax Credit Economic Impact Payments On 2021 Tax Returns

2021 Child Tax Credit Steps To Take To Receive Or Manage

Ensuring Families Who Qualify For The Child Tax Credit Aren T Left Behind Code For America

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

Irs Get Transcript Tool Slowly Coming Back Online More Than A Year After Being Hacked Tax Return Irs Important Life Lessons

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Child Tax Credit Payments Start July 15

Dependent Children 2021 Tax Credit Jnba Financial Advisors

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

No Lines No Waiting You Don T Have To Wait For The Irs Refund At The End Of February Get An Advance Up To 3000 Wh Filing Taxes Accounting Services Tax Time

Can I Claim My Elderly Loved One As A Dependent On My Taxes Tax Deductions Types Of Taxes Deduction